Doubling down on direct-sold deals

Sooner or later, everything old is new again, including the industry’s approach to media buying and selling. Programmatic advertising may have once been the shiny new toy that advertisers couldn’t wait to get their hands on, but we’re seeing a return to old ways, a return to direct-sold deals. While direct-sold deals have always coexisted alongside programmatic, changes in the marketing and advertising landscape are driving publishers to lean heavily on direct-sold again.

In this blog post, we’ll explore how industry changes are driving publishers to build direct-sold ad programs, the challenges advertisers are facing as Big Tech continues to alter the digital landscape, and how publishers can best capitalize on those changes.

The changing programmatic landscape

Ten to fifteen years ago, programmatic presented a vast opportunity for advertisers to reach audiences with greater speed and efficiency than ever before. With programmatic, what would have taken days to execute could be done in seconds, not to mention that programmatic provided advertisers with the capability to achieve precise targeting and deliver relevant ad experiences.

But as programmatic grew, so did its roster of players. Eventually, the programmatic landscape became overcrowded and fragmented, creating more confusion and muddiness. In this confusion, players who offered the most convenient way to identify and target audiences at scale rose to the top as the preferred place to spend dollars; today, we know these as walled gardens. An overreliance on the walled gardens comes with a high price tag; publishers have lost control over their audiences and, in turn, revenue. But recently, we’ve started to see a market correction.

There are several factors at play affecting the industry, contributing to publishers leaning away from programmatic and toward direct-sold deals once again. Chief amongst those factors is the deprecation of third-party cookies. Without them, programmatic advertising faces major limitations, particularly as it pertains to targeting and attribution. This has inspired the industry to look for the next best (and perhaps, better) alternative to identifying and targeting audiences, casting a searchlight on first-party data.

The publisher promise

The industry’s move toward direct-sold deals and away from programmatic is the culmination of several industry changes that have pointed the industry back to publishers. Advertisers are building direct relationships with publishers because they recognize the benefits of partnering with publishers:

- Priority access to premium inventory

- Brand-safe content and contextual targeting

- Custom ad units and sponsorship opportunities in front of captive audiences

- First-party audience data

First-party data is a coveted asset in advertising as it enables advertisers to reach their audiences with great precision while delivering relevant digital experiences. Walled gardens are in a particularly powerful position to aid advertisers in a cookieless world since they’re built on a foundation of logged-in audiences. In other words, walled gardens can offer precision targeting across devices regardless of the third-party cookie’s status. Unfortunately for advertisers, the walled gardens keep their cards close to their chest and don’t share insights on where ads appear or who sees an impression. This gives advertisers little control or insight into their campaigns.

Advertisers have learned that they must diversify their media mix and avoid putting all their eggs in one basket, like walled gardens. By partnering with channels rich in first-party data, advertisers can build out their own first-party data footprints while also achieving precision targeting. But what other sources offer first-party audience targeting besides the walled gardens? Publishers can.

Direct-sold deals: the new, old kid on the block

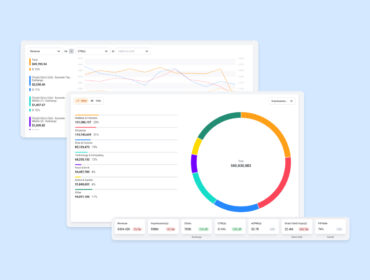

According to Digiday, 71 percent of publishers said that growing their direct-sold revenue would be a top priority. To maximize revenue, publishers must consider all their possible inventory, including email.

71 percent of publishers said that growing their direct-sold revenue would be a top priority.

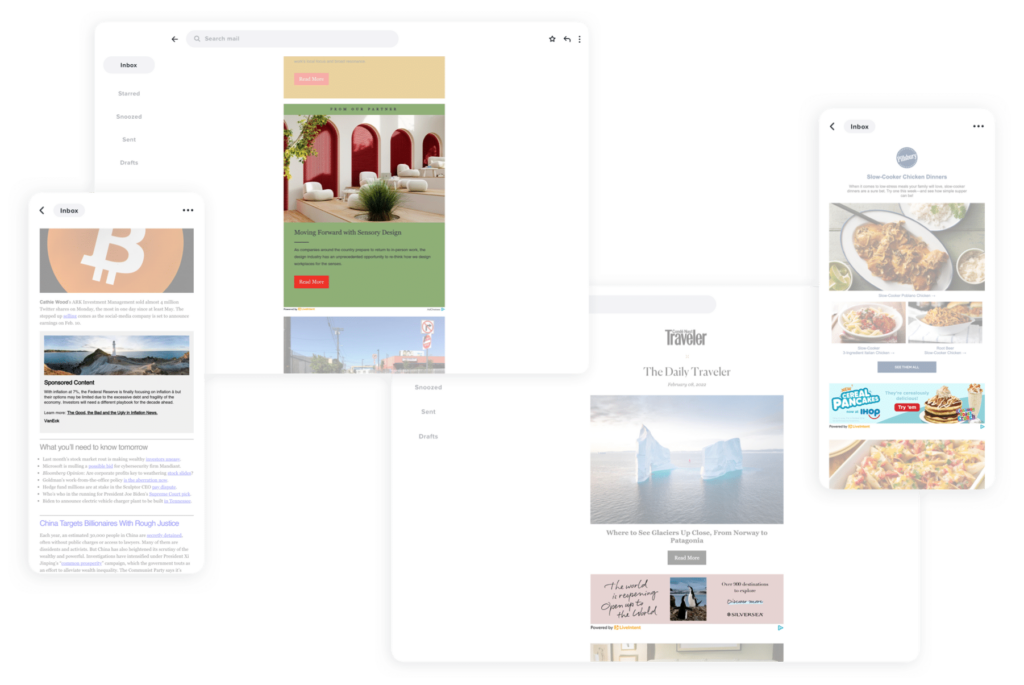

With more than 4.3 billion email users, email newsletters present ample monetization opportunities for publishers. And for advertisers, email provides the chance to get in front of real, logged-in, and engaged audiences in highly visible, privacy-safe inventory. Email newsletters are more than just a content distribution channel these days — and publishers are leaving money on the table by not presenting email as a powerful advertising channel to their sponsors.

Traditionally, direct-sold deals in newsletters involved selling a sponsorship to an advertiser for either a single ad unit or a takeover, tied to a unique send. Due to technological limitations, publishers had to hardcode the ads into each email sent. This approach curbed publisher yield as it impeded running simultaneous campaigns or applying parameters such as audience or date/time bounds. But technology has evolved, allowing publishers to go beyond traditional ways of selling direct-sold deals in newsletters. With the right applications of first-party data, targeting, and technology, publishers can break the direct-sold mold to deliver simultaneous campaigns across multiple advertisers to increase revenue. Let’s dig into some of the ways you can do this.

Content packages

With the latest shifts in programmatic limiting the hypertargeting of individuals, we’re seeing a resurgence in contextual advertising. Publishers that produce newsletters across a variety of topics can create inventory packages that align sponsors’ ads to content within relevant subject matter, creating a more tailored ad experience for readers.

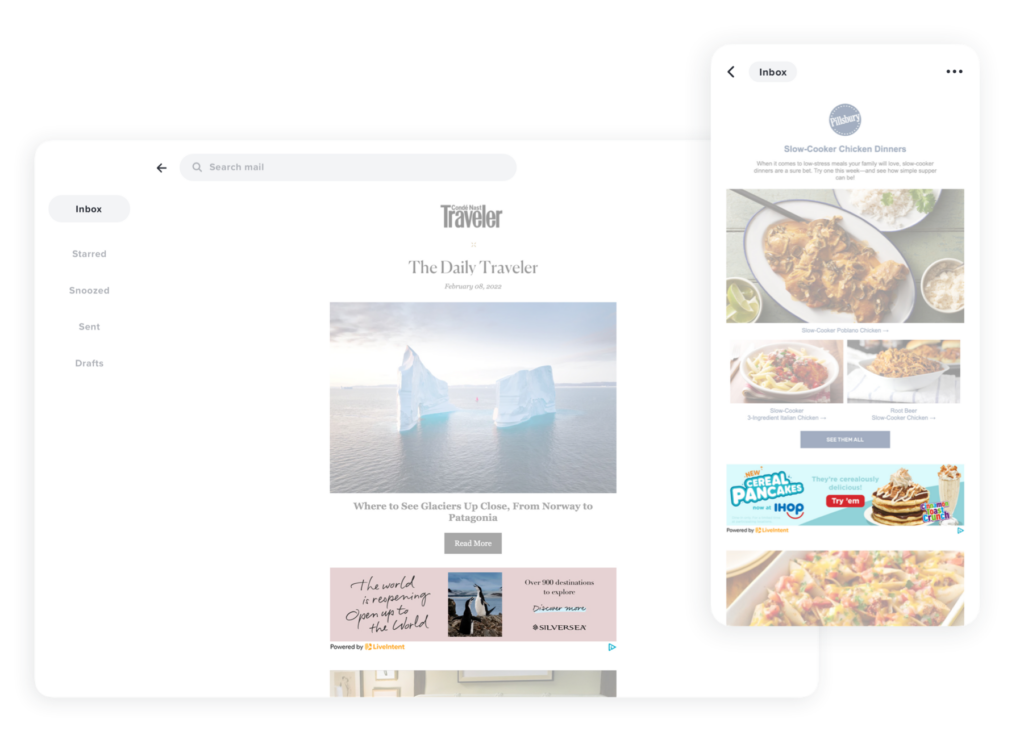

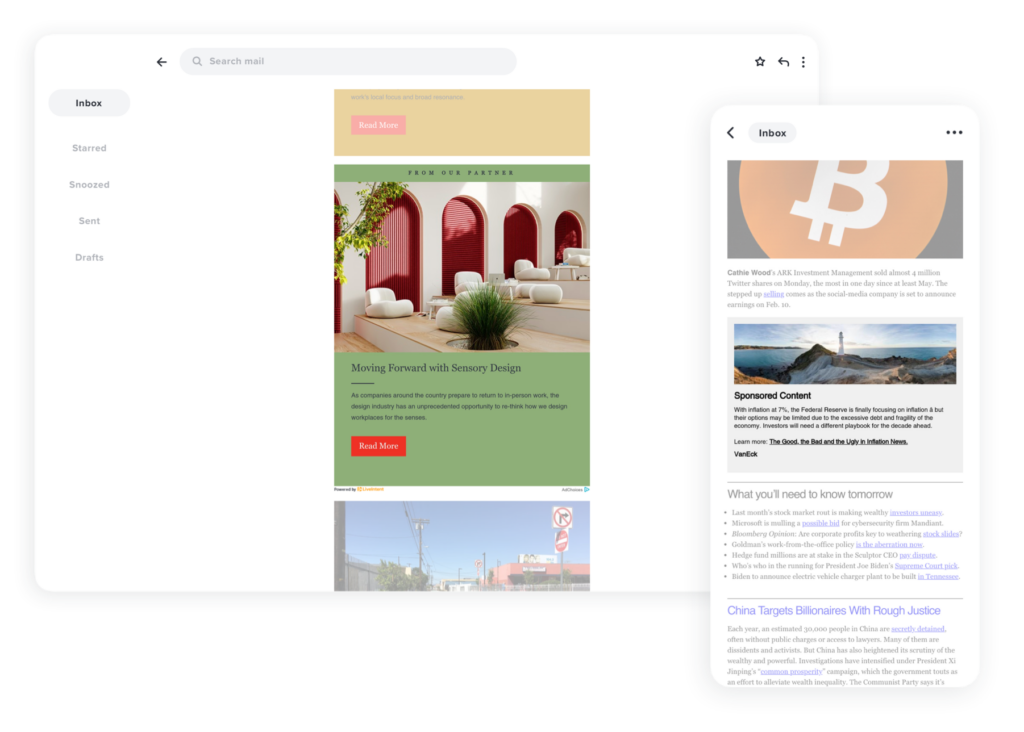

Publishers can incorporate custom ad formats in email newsletters with solutions like LiveIntent’s Native Ad Blueprints. Custom native ad forms elevate sponsor messages and provide the endorsement advertisers are looking for from partnerships with premium publishers.

Seasonal

Contextually relevant advertising doesn’t end with content. If you produce content dedicated to a season, holiday, or special event, consider creating advertising packages for brands that want to capitalize on seasonal relevance. Say you produce a newsletter dedicated to home & garden tips and projects. In preparation for spring, you could create inventory packages that appeal to brands that want to promote spring cleaning supplies, accessories to design a garden oasis after the winter, or seeds and soil to start planting in time to enjoy summertime blooms, for example.

Regional

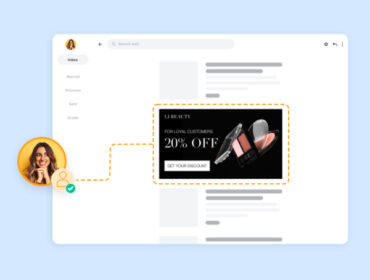

One way publishers can run simultaneous campaigns in their newsletter is to apply targeting parameters (like age, gender, key-value pairs) to accept demand from multiple sources, boost fill rate and, ultimately, yield. Let’s look at an example.

A local minor league baseball team is running a ticket drive and wants to reach local sports fans in Massachusetts and Connecticut. However, they don’t want to advertise to anyone who’s already bought a ticket.

To reach the advertiser’s desired audience, you can work with a partner like LiveIntent to onboard a list of ticket purchasers and suppress them from the campaign while targeting newsletter subscribers that reside in Massachusetts and Connecticut. By maximizing effectiveness with data and targeting, you can offer this type of campaign to advertisers at a premium. Furthermore, you can allow campaigns from other relevant advertisers to appear in front of readers in other states without having to manage multiple tags or break up your send list.

Having these options at your disposal allows you to expand your direct-sold deals and run multiple deals across several advertisers, serve relevant ad experiences, and optimize yield.

Audience

With the deprecation of third-party audience targeting options, advertisers are turning to publishers for audience insights to help them get in front of the right consumers. In a recent survey by CoLab Media Consulting and Beeler.Tech, 57 percent of publishers shared that they will focus on leveraging their first-party audience data to build programmatic direct deals.

57 percent of publishers shared that they will focus on leveraging their first-party audience data to build programmatic direct deals

The time has never been better to use the unique insights about readers’ interests, lifestyles, and behaviors to assemble audience packages that appeal to advertisers, especially as they seek out audience insights that complement their own first-party data. If you’re working with a platform that enables audience targeting at time of impression, you can save time by setting up direct deals to target an audience within a single newsletter or across multiple newsletters.

With a little help from your friends…and tech

With the right vendors and technology in place, you and your teams can improve efficiency and optimize yield, freeing up valuable time and resources so you can focus on landing more direct-sold deals and growing your business. LiveIntent is here to help and will continue to invest in direct-sold capabilities to help the entire publisher community thrive in an increasingly complicated digital marketplace.

Interested in learning more about LiveIntent’s direct-sold solutions? Read more here about how our features and tools can help meet your needs.